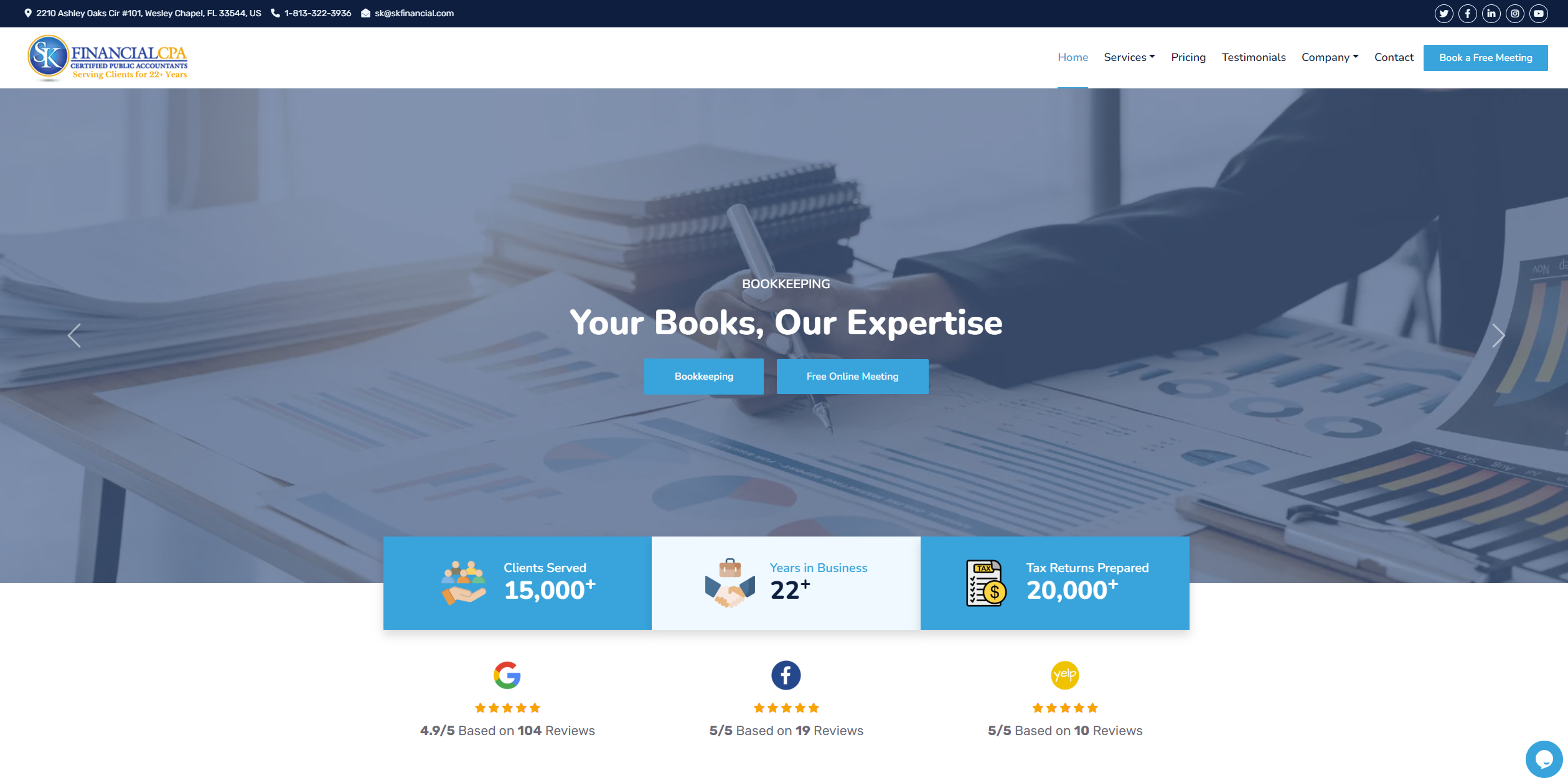

Your expert, cheap, and trusted financial partner in New Tampa

Since 2002, SK Financial CPA has established itself as a full-service CPA and business consulting firm. We are committed to providing expert tax solutions and strategic financial planning to individuals and businesses in Tampa, Florida, USA.